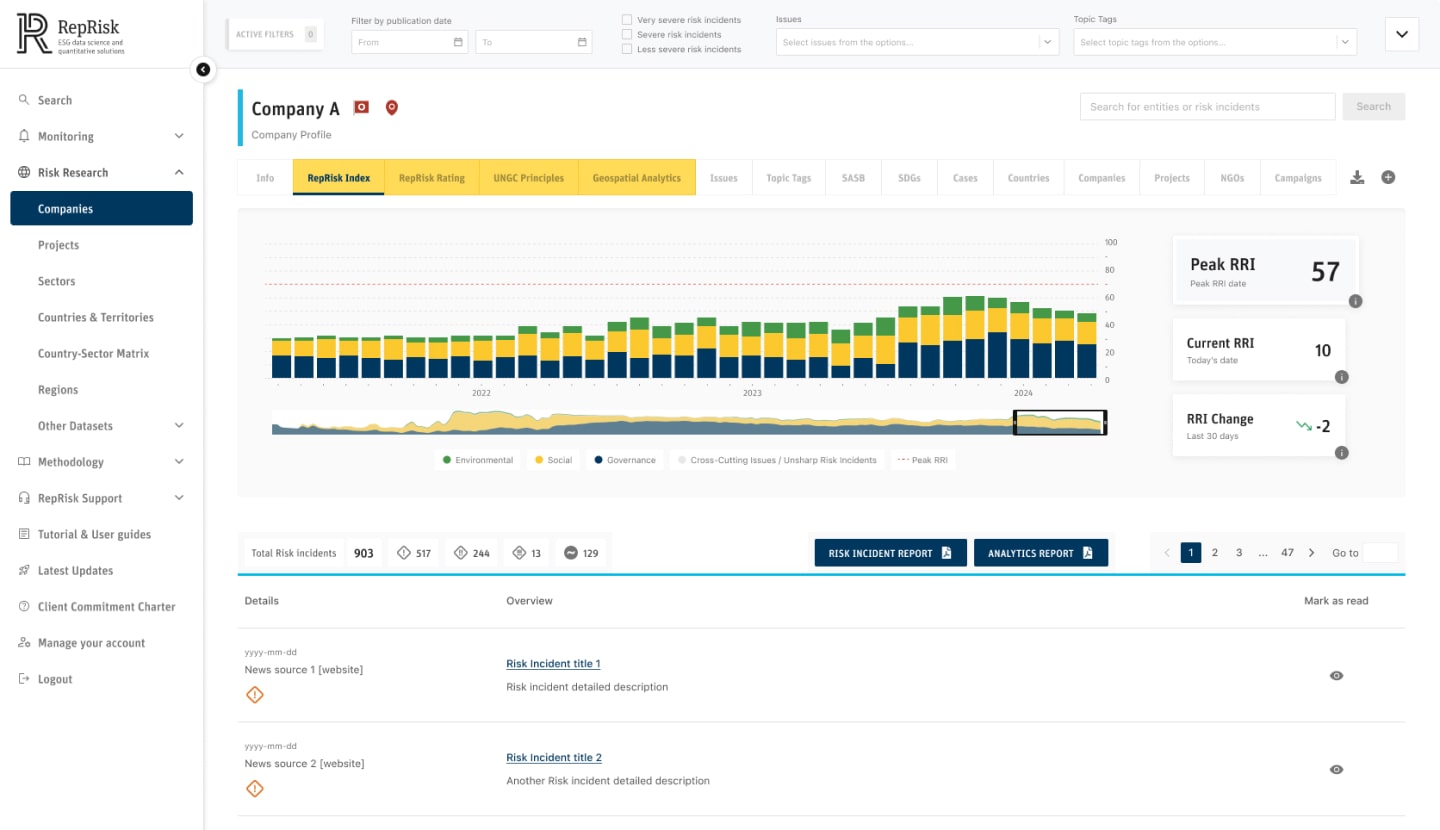

Your trusted source for actionable risk intelligence at every stage of the client lifecycle

In today’s dynamic markets, banks must balance origination and growth with rigorous reputational, compliance, and financial business conduct risk management. RepRisk gives you timely, outside in risk intelligence, validated by experts and powered by advanced AI, to integrate risk considerations across the enterprise, from KYC and onboarding to transaction due diligence and portfolio oversight.

Banking use cases: where RepRisk adds value

-

Client onboarding & KYC

Screen clients for business conduct and reputational risks. Automate risk monitoring and alerts for ongoing compliance. -

Transaction due diligence

Integrate RepRisk data into approval workflows for lending, project finance, trade finance, IPOs, and credit. Standardize checks. -

Reputational risk management

Detect risk early warning signals before they become financial liabilities. Benchmark against peers and sector trends. -

ESR / sustainability frameworks

Apply norms-based screening (UNGC, UNGPs, OECD, SDGs, SASB, EU Taxonomy, SFDR) to align financing decisions with your bank’s policies. -

Third party & procurement risk

Filter, monitor, and assess suppliers and third parties across onboarding and supply chains using Country-Sector metrics and watchlists.