# The challenge

A leading international bank set out to align its credit processes with its corporate social responsibility (CSR) and sustainability strategy, ensuring that financing decisions supported responsible business conduct and long-term value creation. However, the bank faced several challenges:

- Traditional credit assessments often lacked a holistic view of business conduct risks.

- Existing processes relied on fragmented data sources, making it difficult to consistently evaluate clients’ business conduct and reputational risk profiles.

- The bank needed a scalable solution to expand its sustainability framework beyond large corporates, covering a broader client base and a wider range of risk factors, especially for medium-sized corporates and financial institutions.

# The solution

To address these challenges, the bank integrated RepRisk’s comprehensive data into its credit decision-making process. This integration enabled the bank to:

- Conduct thorough business conduct risk reviews throughout the entire credit lifecycle, from initial screening to ongoing monitoring.

- Leverage RepRisk’s proprietary metrics, including the RepRisk Index (RRI), RepRisk Risk Rating (RRR), and UN Global Compact (UNGC) Violator Scores, to benchmark clients against sector peers and identify potential risks early.

- Expand its sustainability framework to include medium-sized corporates and financial institutions, ensuring consistent application of risk standards across the portfolio.

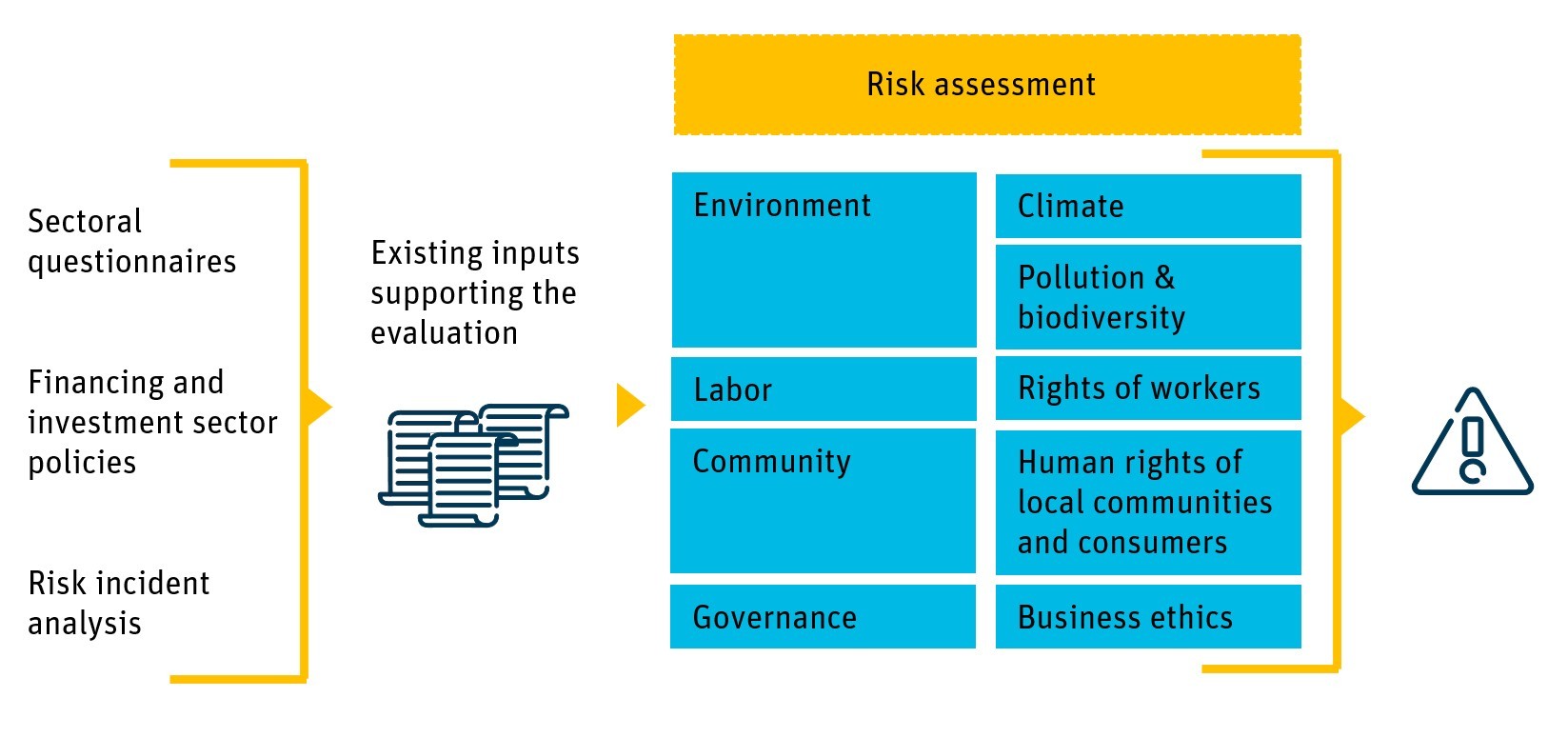

- Support sectoral questionnaires, investment policies, and risk incident analysis with timely, actionable insights from RepRisk data.

# The impact

By embedding RepRisk data into its sustainable credit decision process, the bank achieved:

- Comprehensive client risk profiles: The bank now benefits from a holistic view of each client’s business conduct, integrating environmental, social, and governance factors into every credit decision.

- Enhanced sustainable financing: The approach supports the bank’s commitment to financing clients aligned with its sustainability strategy, while proactively identifying and managing reputational risks.

- Scalable and consistent assessments: The expanded framework ensures that all clients, regardless of size, are evaluated using the same rigorous criteria, supporting responsible growth and regulatory compliance.

- Timely, data-driven insights: RepRisk’s daily data delivery empowers credit teams to make informed decisions quickly, reducing manual research and accelerating the credit approval process.

# Why it matters

RepRisk’s data integration enables banks to operationalize sustainable finance, embed business conduct risk into core credit processes, and drive positive impact across their client base. By leveraging RepRisk, financial institutions can confidently support responsible clients, manage risk, and uphold their commitments to sustainability.

Learn more

To understand how your institution can integrate RepRisk’s data into your workflows, request a demo.

Copyright 2025 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.