# The challenge

A leading global bank faced a critical challenge: its commercial bankers often lacked the expertise and tools to effectively assess environmental and social (E&S) risks during deal origination and client onboarding. Traditional financial risk frameworks did not account for business conduct risk factors, resulting in inconsistent evaluations and the potential for missed reputational risks. This gap exposed the bank to unforeseen liabilities and undermined its commitment to responsible business practices.

# The solution

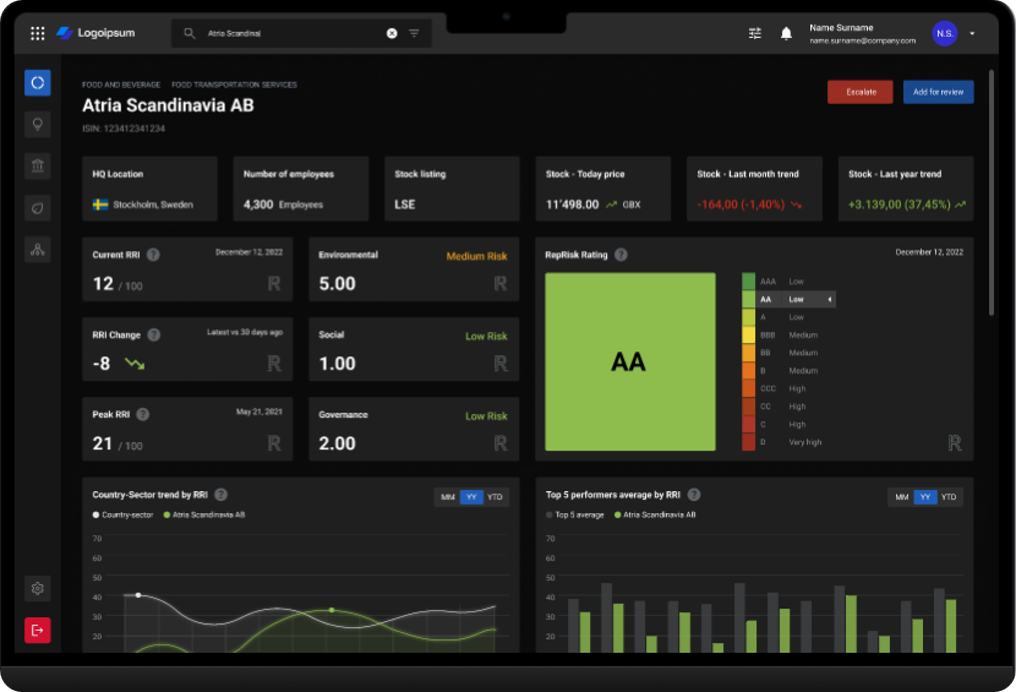

Anonymized image for illustrative purposes only.

To address these challenges, the bank partnered with RepRisk to embed a data feed directly into its internal risk assessment dashboard. This integration enabled the bank to:

- Surface the most material E&S risks for each company under review, mapped to the bank’s own internal assessment criteria.

- Provide bankers with a clear, data-driven “Go/No-Go” recommendation for each deal, along with tailored next steps aligned to the bank’s risk appetite.

- Standardize the risk screening process across all sectors and geographies, ensuring consistency and comparability in decision-making.

The dashboard’s intuitive interface empowered bankers, regardless of their prior E&S expertise, to make informed, transparent, and auditable decisions, reducing reliance on subjective judgement.

# The impact

By integrating RepRisk data into its deal-level risk assessment workflow, the bank achieved:

- Consistent and standardized risk screening: Every deal, regardless of sector or geography, is evaluated using the same robust criteria, reducing the risk of oversight and ensuring alignment with the bank’s global standards.

- Reduced subjectivity: Automated, data-driven recommendations replaced ad hoc, manual assessments, minimizing bias and human error.

- Enhanced transparency and auditability: All decisions are traceable, with clear documentation of the underlying risk factors and rationale, supporting regulatory compliance and internal governance.

- Improved risk management: The bank can proactively identify and mitigate reputational risks before they materialize, protecting both its clients and its own brand.

# Why it matters

RepRisk’s data integration empowers financial institutions to operationalize responsible business conduct, embed sustainability into core processes, and build trust with clients and stakeholders. By leveraging RepRisk, banks can confidently navigate the complexities of E&S risk, drive better business outcomes, and uphold their commitments to sustainable finance.

Learn more

To understand how your institution can integrate RepRisk’s data into your workflows, request a demo.

Copyright 2025 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.