# The challenge

When conducting due diligence, commercial bankers often encounter situations where a target company has no recent risk incidents on record. In these cases, it becomes difficult to assess the company’s exposure to reputational and business conduct risks using traditional methods. Without contextual data, bankers may overlook sector-wide or geographic risk trends, potentially leading to incomplete or delayed evaluations.

# The solution

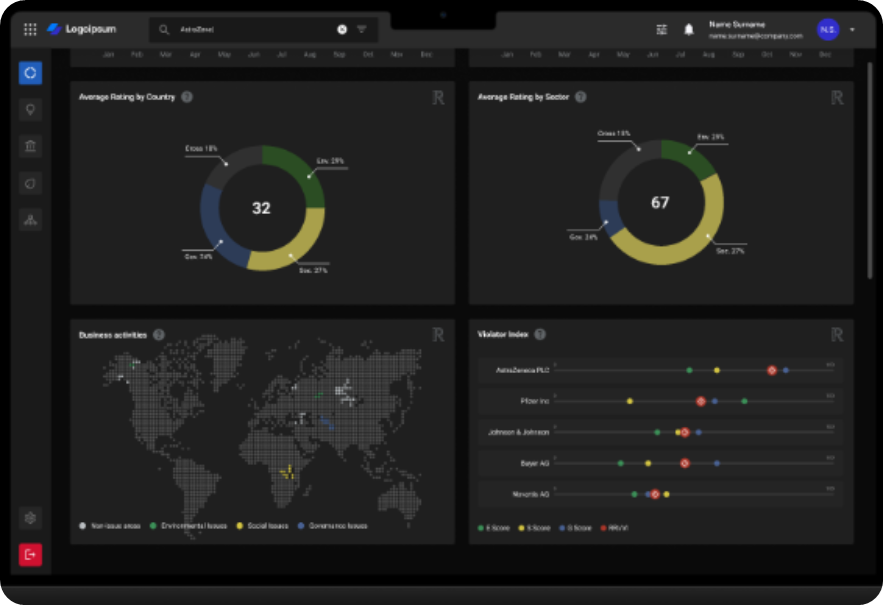

Anonymized image for illustrative purposes only.

To address this challenge, a commercial bank integrated RepRisk’s data into a custom dashboard designed to provide country- and sector-level risk profiling. This dashboard enables bankers to:

- Instantly view the top reputational risks affecting peer companies within the same sector or geography as the target company.

- Access RepRisk’s unique metrics, including the RepRisk Index (RRI), RepRisk Risk Rating (RRR), and UN Global Compact (UNGC) Violator Scores, to benchmark risk exposure even when direct incidents are absent.

- Gain a broader perspective on emerging risks and sectoral trends, supporting a more comprehensive and forward-looking due diligence process.

By leveraging peer and sector data, the bank ensures that risk assessments are not limited by the absence of company-specific incidents, but instead are informed by the wider risk landscape.

# The impact

With RepRisk’s country-sector risk profiling, the bank achieved:

- Broader risk visibility: Bankers can now identify and understand reputational risks that may not be immediately apparent at the company level, but are prevalent within the sector or region.

- Stronger early-stage evaluation: The dashboard supports early-stage deal screening, allowing bankers to flag potential concerns before they escalate, and to prioritize further investigation where sector or country risks are high.

- Informed decision-making: By benchmarking the target company against its peers, bankers make more objective, data-driven decisions, reducing the likelihood of oversight.

- Strengthened due diligence: The integration of RepRisk data ensures that all relevant risk factors, whether company-specific or contextual, are considered, resulting in more robust and defensible due diligence outcomes.

# Why it matters

RepRisk’s data empowers banks to move beyond company-level analysis and incorporate sector and geographic risk intelligence into their workflows. By doing so, financial institutions can better anticipate emerging risks, enhance the quality of their due diligence, and make more confident decisions.

Learn more

To understand how your institution can integrate RepRisk’s data into your workflows, request a demo.

Copyright 2025 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.