Using non-optimized ESG data and metrics to identify and assess investment and portfolio risks

To highlight materiality of ESG factors in investments, it is important to avoid noise and ambiguity in data that can make investors prone to confirmation bias. Risk-focused ESG data can facilitate a consistent approach to investment risk management, providing timely information that can be optimized as a portfolio risk overlay and enable investors to act faster. Moreover, by integrating quantifiable and comparable ESG risk metrics into existing models, investors can run portfolio simulation on historic data points to obtain a more comprehensive view of the actual value, volatility, and return of a potential investment—as well as to avoid ESG-related risk events in the future.

ESG Data—More Relevance, Less Noise

Business conduct risks related to human rights, labor, the environment, and corruption can translate into reputational, compliance, and financial risks for companies. How they manage such issues is recognized as a long-term value driver and can be perceived as directly linked to their operational excellence and social license to operate.

In 2018, most major asset managers are committed to incorporating ESG criteria and risk factors in their investment approach. According to the UN’s Principles for Responsible Investment (UNPRI), nine out of ten of the world’s largest fund managers have signed the principles.

Apart from the responsibilities a corporate citizen has to adhere to sustainability mandates and ESG investment frameworks, investors also have an incentive to systematically reduce blind spots and shed light on hidden risks in their investment portfolios. To facilitate this, an investor has a need for daily updated risk signals in order to act ahead of time, methodically exploit market inefficiencies, and ultimately, to generate alpha while controlling undesirable volatility. From a risk-return perspective, this would be the ideal combination.

As increasing numbers of investors seek to integrate sustainability and ESG risk factors in their investment strategies, it is becoming clear that there is a lack of clarity with regard to the various approaches adopted as well as a sense of frustration that there is no general consensus about what is financially material in this context. Moreover, there might be, for some investors, a perception of high costs associated with gathering and analyzing ESG data. As such, finding the right set of data to fill the information gap is a major obstacle to ESG playing a principal role in steering investment decisions. Investors are generally asking, “Which factors and underlying data should we consider, what are the key sources of ESG risks and subsequent value creation for a particular industry or company, and which long-term risk patterns are likely to have a negative impact on these value drivers?”

Intangible values: Alternative ESG Data Can Reveal Hidden Risks

ESG data can help investors better understand the value of intangible ESG factors and their associated risks, which is important since ESG performance can be directly related to companies’ revenues and costs. Therefore, it is key to monitor how portfolio companies manage these issues, as this can have a financially material impact on stock performance and its long-term value. Moreover, aggregated ESG data and changes in such metrics can help to identify the underlying causes of a stock’s volatility.

To highlight an example: Bayer AG is currently facing a protracted legal battle involving thousands of lawsuits related to the cancer verdict against its subsidiary, Monsanto Co. As a result, this recently led to a substantial slump in Bayer’s share price, dropping 19.5 % on Aug 13 this year. The company and its shareholders have suffered a substantial blow in the financial market that has not only wiped out assets by the USD billions, but also has destroyed intangible yet no less important value. Is there a way this could have been predicted? Can such ESG-related events systematically be identified, and portfolios be positioned to avoid significant drawdowns like the one currently experienced by Bayer?

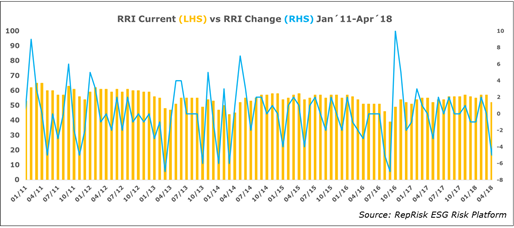

Besides being in the crosshairs of environmentalists for decades, Monsanto had already been consistently ranked in a high-risk category by RepRisk’s proprietary risk metrics and with multiple high severity risk incidents linked to ESG issues and the alleged violations of the ten principles of the UN Global Compact. In fact, there were already more than 220 individual risk incidents reported on the Roundup weed killer between October 1, 2005 and August 12, 2018, as well as over 150 risk incidents directly related to Monsanto. Moreover, judged by the frequent movements and increase in the monthly RRI, it is most likely that the company struggled to improve its exposure to and handling of ESG Issues. A stable RRI below the high-risk threshold of 50 would have been an indicator of a better ESG performance.

By using risk-focused ESG data, investors can identify serious ESG allegations early that make the case for divestment decisions depending on an investors risk appetite. Similarly, Bayer themselves, upon identifying potential future consequences of the long-standing ESG issues related to Monsanto, could have launched mitigation plans during commercial negotiations and quantified the ESG risk exposure to be significantly discounted to the acquisition cost.

Risk-focused ESG Data: Shifting the Information Barrier for Investors

The example above is not unique. Consider BP or Volkswagen’s serious environmental scandals involving oil spills and falsified emission statistics. Before these major ESG risks materialized, traditional credit rating bureaus and other stakeholders failed to detect the lingering exposure before the significant consequences became evident and translated into market losses. Given the probability of such incidents being able to dramatically impact the value of an investor`s portfolio, the speed of access to relevant ESG data, and the ability to translate this to quantitative insight, would enable an investor to act promptly. Well-capitalized companies like BP and Volkswagen often distribute non-financial data, such as sustainability reports, which contribute to a misleading picture about their ESG performance. However, this does not necessarily provide the full picture of the on-the-ground management of ESG issues—merely their aim and intention. What might be a long-term, systematically concealed negligence and poor health and safety management can be camouflaged in CSR reports by citing training and educational procedures, describing safety processes, and so on. Investors may fail to pick up on this unless they adopt an alternative risk assessment approach for their investment universe.

In fact, as early as June 2013—two years before the Volkswagen scandal—a report by the NGO International Council on Clean Transportation (ICCT) claimed that carbon emissions declared by car manufacturers, including Volkswagen, were an average of 25 percent higher than the figures communicated. In September 2014, such information was once again exposed in another ICCT report entitled From Laboratory to Road, which alleged that car manufacturers in Europe, including Audi, BMW, and Mercedes-Benz, had falsified their fuel consumption statements by up to 50 percent in 2013.

What does this tell us? Risk-focused ESG data can provide investors with a complementary on-the-ground performance assessment. Such information facilitates holistic due diligence and portfolio monitoring using quantifiable and comparable data that enables speedy action when risk signals are received. It also allows investors to hedge potential portfolio drawdowns, i.e. a certain minimum frequency of severe risk incidents related to a particular ESG issue in a specific sector is XX % likely to have a negative impact of at least YY bps and increase beta of a stock by ZZ %.

This blog post was posted on FactSet Insight.

About RepRisk

RepRisk is the world’s most respected Data as a Service (DaaS) company for reputational risks and responsible business conduct. From 2007, RepRisk’s data has been trusted by the world’s leading banks, investment managers, Fortune 500 companies, sovereign wealth funds, and organizations such as the OECD, UN, and the World Bank. Combining advanced AI with deep human expertise, and a proven methodology at the core, RepRisk’s solutions bring peace of mind, enabling clients to ‘know more, be sure, and act faster’. Our pioneering solutions help to strengthen due diligence processes across ESG topics, such as biodiversity, deforestation, human rights, and corruption, empowering clients to identify, monitor, and mitigate reputational, compliance, and financial risks. Headquartered in Zurich, and with offices in Toronto, New York, London, Berlin, Manila, and Tokyo, we stay close to clients and bring an independent lens to the industry. United by our shared belief in the power of data, our 400 people are proud to be setting the global standard for business conduct data and driving positive change through transparency.

Visit us at www.reprisk.com.