Biodiversity: a critical aspect of ESG

The current state of global biodiversity is characterized by alarming declines and widespread degradation. Numerous studies, including the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) Global Assessment Report, stated that species extinction rates are accelerating, populations of wild animals have plummeted, and habitats continue to shrink at an unprecedented pace. The consequences of this crisis extend beyond the natural world, affecting human well-being, food security, and economic stability. As a result, governments, businesses, and civil society are increasingly recognizing the urgency of addressing biodiversity loss and investing in nature-based solutions.

The Principles of Responsible Investment (PRI) states that biodiversity encompasses the diverse living elements of the natural world and plays a crucial role in safeguarding the resilience of essential natural resources that society and businesses rely on. Nevertheless, biodiversity and ecosystems are being depleted primarily by human activities, such as deforestation, pollution, and overexploitation of resources. This loss presents both risks and opportunities for society, businesses, and investors.

# I. What is biodiversity and why is it a crucial aspect of ESG?

In the context of the Convention on Biological Diversity (CBD), biodiversity is defined as “the variability among living organisms from all sources including, inter alia, terrestrial, marine, and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species, and of ecosystems.”

Biodiversity loss directly affects ecosystem services such as pollination, water purification, and soil fertility, which are essential for the environment and human survival. Communities, especially indigenous and local populations, depend on biodiversity for their livelihoods, cultural heritage, and well-being. Loss of biodiversity can lead to social and economic challenges. Effective governance structures are needed to manage biodiversity-related risks and ensure sustainable business practices. Companies are expected to demonstrate responsibility and leadership in conserving biodiversity.

# II. What are the key frameworks addressing biodiversity?

- The United Nations established the Convention on Biological Diversity (CBD) to advance nature and human welfare. The initial proposal was put forth on May 22, 1992, which was subsequently recognized as International Biodiversity Day. Following the Rio Earth Summit, nearly 200 nations have ratified this treaty, which obligates them to preserve biological diversity, use its components sustainably, and fairly distribute the benefits derived from genetic resources.

- Since 2003, the Cartagena Protocol on Biosafety (BSP) under the CDB addresses the safe transfer, handling, and use of living-modified organisms (LMOs) resulting from modern biotechnology that may have adverse effects on biodiversity, taking into account risks to human health.

- In 2010, the Nagoya Protocol on Access and Benefit-sharing was adopted under the CBD. It provided a framework for the fair and equitable sharing of benefits arising from the utilization of genetic resources, aiming to ensure that benefits are shared in a transparent and equitable manner.

- Additionally, the UN Sustainable Development Goals (SDGs) Goal 15 specifically addresses the protection, restoration, and sustainable use of terrestrial and marine ecosystems. Several other SDGs indirectly contribute to biodiversity conservation, such as Goal 13 on climate action and Goal 14 on life below water.

- At the 15th UN Biodiversity Conference (COP15) in December 2022, the CBD adopted the Kunming-Montreal Global Biodiversity Framework (GBF).

- This framework aims to safeguard 30% of the Earth's land, ocean, and inland waters, along with 23 other targets to preserve ecosystems and endangered species globally by 2030.

- It also requires major corporations to reveal biodiversity risks and impacts from their activities. Additionally, the framework emphasizes the need to raise biodiversity funding by a minimum of USD 200 billion annually, with at least USD 30 billion per year allocated to developing countries by 2030.

- The financial sector has taken note of the growing international support for biodiversity conservation and protection. One of the key initiatives from the sector is the Taskforce on Nature-related Financial Disclosures (TNFD). Its final framework was published in September 2023.

- The TNFD aims to provide guidance on how organizations can assess and report on their dependencies and impacts on nature, as well as their responses to these issues.

- The recommendations under TNFD are structured around four pillars – governance, strategy, risk and impact management, and metrics and targets, consistent with the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB).

- In January 2024, the Global Reporting Initiative (GRI) published the revised version of its biodiversity standard.

- It contains new disclosures on the direct drivers of biodiversity loss and impacts on society (i.e. how indigenous people, local communities, and other social groups may be affected by a company’s impacts on biodiversity).

- It also includes supply chain and location-specific disclosures. The new standard will become effective on January 1, 2026, when it will supersede GRI 304: Biodiversity 2016. The GRI will pilot the new standard with early adopters in 2024 and 2025.

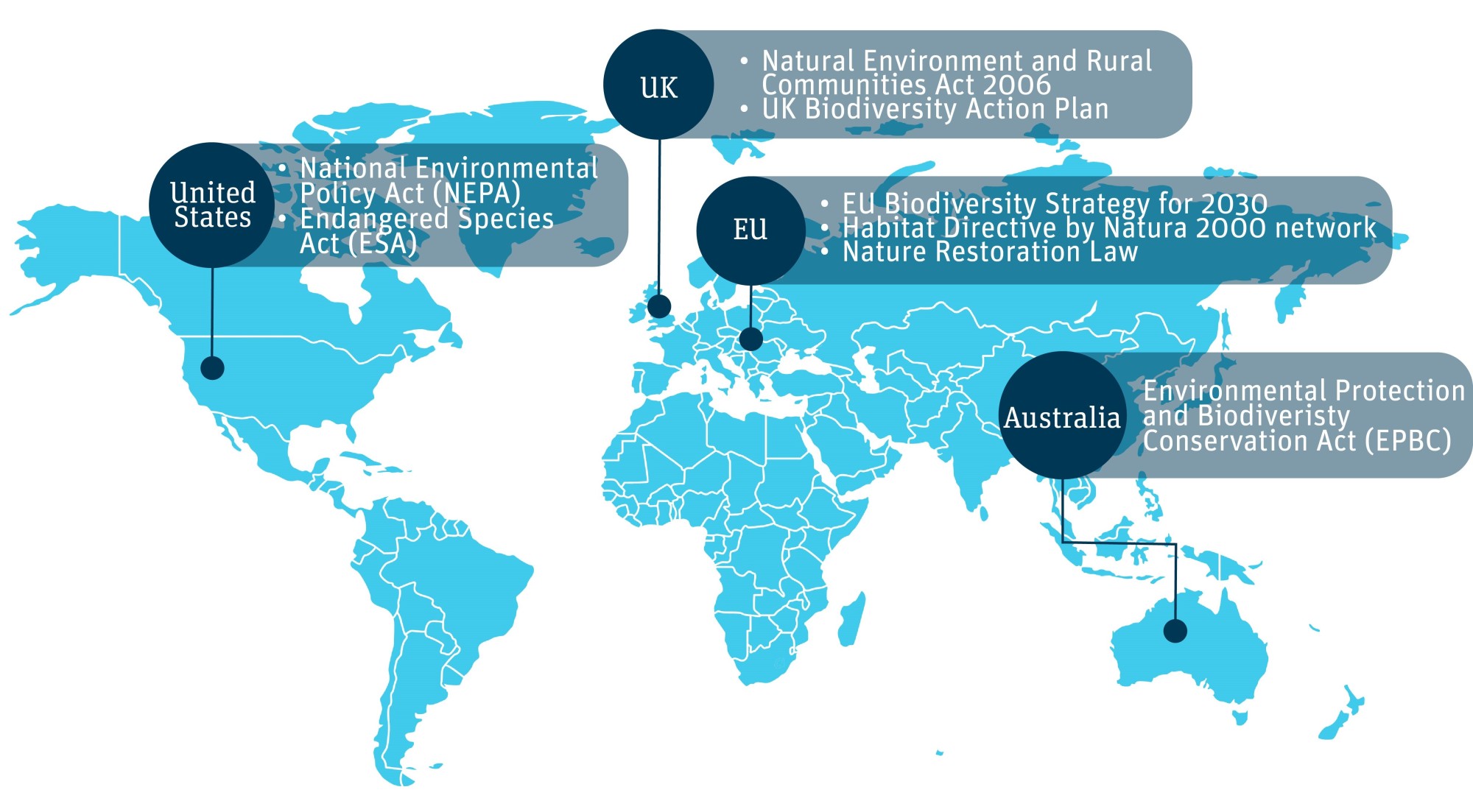

# III. How are jurisdictions addressing biodiversity?

Many jurisdictions have specific regulations at regional and local levels, such as land-use planning laws, protected area regulations, and fisheries management measures, that aim to address biodiversity conservation in specific contexts. Here are some notable regulatory developments specifically addressing biodiversity:

- European Union:

- EU Biodiversity Strategy for 2030: as part of the European Green Deal, this strategy aims to put Europe's biodiversity on the path to recovery by 2030. It includes ambitious targets such as protecting 30% of the EU’s land and sea areas, restoring degraded ecosystems, and ensuring sustainable use of natural resources.

- Habitat Directive: established the Natura 2000 network, a system of protected areas aimed at conserving natural habitats and species across Europe. It works alongside the Birds Directive to safeguard biodiversity.

- Nature Restoration Law: a key element of the EU Biodiversity Strategy for 2030, once enforced, it will be the first comprehensive and continent-wide regulation of its kind. It aims to set legally binding targets for nature restoration on a continental scale.

- United States:

- National Environmental Policy Act (NEPA): requires federal agencies to assess the environmental effects of their proposed actions before making decisions, including impacts on biodiversity.

- Endangered Species Act (ESA): aimed at protecting and recovering imperiled species and the ecosystems upon which they depend. It provides for the conservation of species that are endangered or threatened and conserves their habitats.

- Australia:

- Environment Protection and Biodiversity Conservation Act (EPBC): provides a legal framework to protect and manage nationally and internationally important flora, fauna, ecological communities, and heritage places.

- United Kingdom:

- Natural Environment and Rural Communities Act 2006: provides the legal framework for biodiversity conservation in the UK.

- UK Biodiversity Action Plan: sets out a series of targets and actions to protect and enhance biodiversity in the UK.

The rise of biodiversity regulations is driven by increasing awareness of the critical role biodiversity plays in maintaining ecological balance and supporting human well-being. Governments and international bodies are implementing regulations to protect natural habitats, endangered species, and ecosystem services. This regulatory focus is crucial for addressing ESG issues, as biodiversity loss poses significant risks to businesses and is interconnected with other ESG factors such as climate change and social equity. Recognizing the importance of biodiversity in ESG frameworks allows companies to manage risks, meet stakeholder expectations, and contribute to sustainable and responsible business practices.

Want to learn more about how RepRisk solutions address biodiversity?

Contact your Account Manager or our Client Services Team (support@reprisk.com)

Copyright 2024 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this report. This information herein is given in summary form and RepRisk AG and/or the third party contributors to this report make no representation or warranty that any data or information supplied to or by it or them is complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall RepRisk AG and/or the third party contributors to this report have any liability (whether in negligence or otherwise) to any person in connection with the information contained herein. Any reference to or distribution of this report must include a link to the content to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision, and is not intended to constitute or to be used as a substitute for legal, tax, accounting, or other professional advice. Please note that the information may have become outdated since its publication. Should you wish to obtain a quote for our services, please contact us.