# I. Introduction

Supply chains are an essential part of the business process, and they impact business continuity and profitability. Yet, as supply chains frequently cross borders and responsibility becomes fuzzy as degrees of separation from suppliers increase, they are prone to risks, especially ESG and business conduct risks – which can translate into bottom-line financial, reputational, and compliance impacts for companies involved.

To mitigate and prevent adverse impacts, companies rely on data for decision-making in their risk assessment and screening processes related to suppliers and supplier facilities. For suppliers in emerging and frontier markets, ESG data is difficult to gather and access, or, if available, it’s mostly self-reported – and therefore unreliable, especially when it comes to risks – outdated, and incomplete. Despite this data gap, companies are expected to comply with emerging regulations and standards such as the Modern Slavery Act 2015.

In this challenging environment with increased regulatory scrutiny, the COVID-19 pandemic posed a unique and unexpected condition, altering both supply and demand patterns at the same time, while amplifying existing ESG risks. For many companies, the pandemic and subsequent disruptions led to consideration of supply chain diversification or even bringing operations closer to home in a trend called re-shoring. This report investigates how the nature of supply chain related ESG risk incidents has transformed during the COVID-19 pandemic and outlines how companies can navigate the changing landscape.

# II. How the pandemic disrupts the ESG risk landscape of supply chains

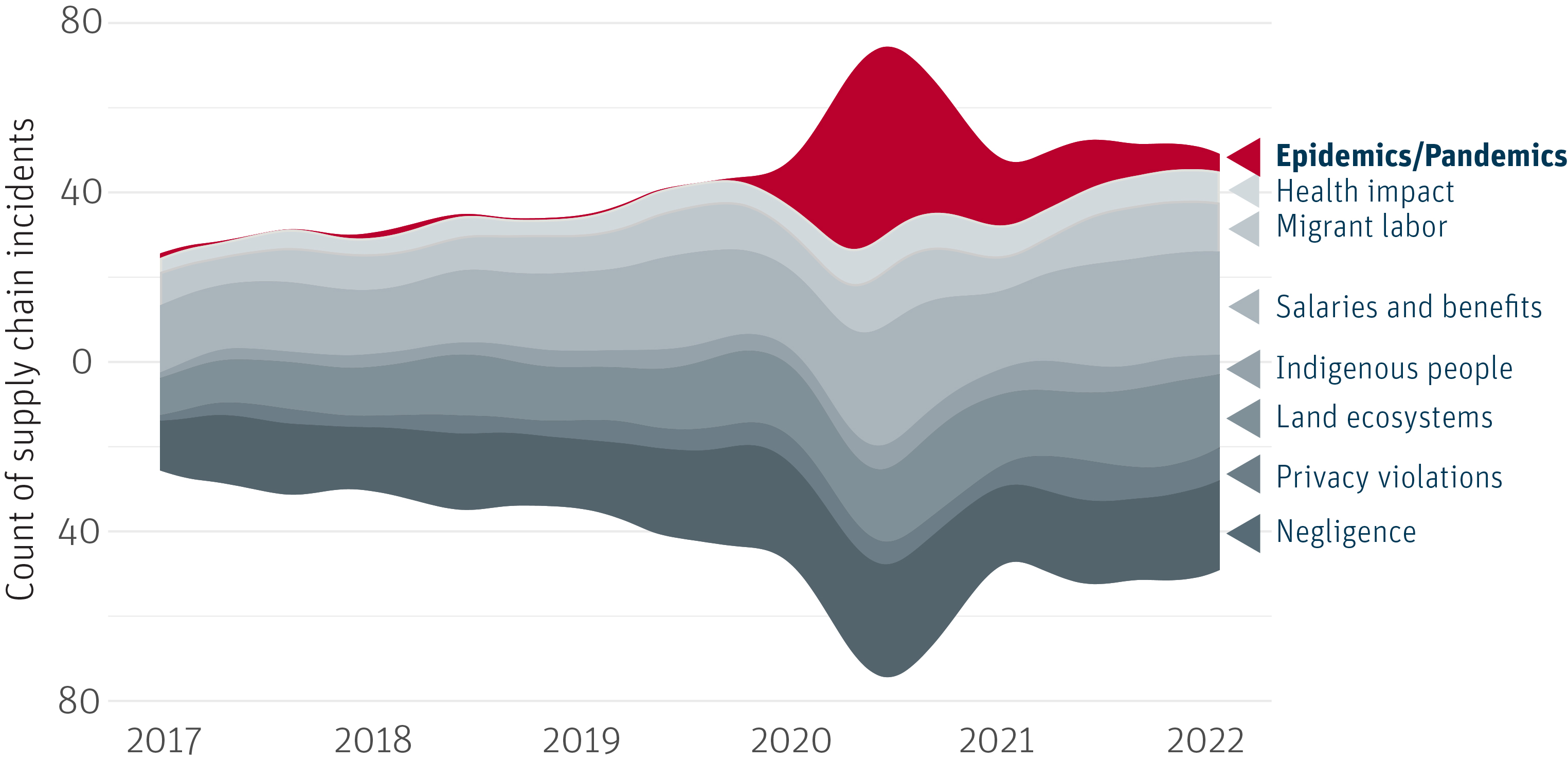

Over the past two years, eleven percent of companies (approximately 7,500) in the RepRisk dataset with incidents during this period were linked to a supply chain risk incident. In the Retail and Personal and Household Goods sectors, this percentage increased to 25% (approximately 2,200 companies of 9,000) and 28% (approximately 1,900 companies of 6,900), respectively. Reviewing the past five years of supply chain incident data, we observed a noticeable disruption in 2020 and 2021 to the traditional distribution of key topics for supply chains.

# III. Disruption of top ESG issues linked to supply chains

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com