Early detection of business conduct risks and the cost of ignoring warning signs

# I. What happened

# Chiquita faced more than USD 60 million in penalties after making “protection” payments to a terrorist group in Columbia.

Chiquita Brands International, a leading global producer and distributor of bananas, operates across 25 countries with roughly 20,000 employees. Until its takeover in 2014 by a coalition of Brazilian companies, Cutrale Group and Safra Group, it was a publicly traded company listed on the New York Stock Exchange.

In 2007, the company pleaded guilty to charges brought by the US Justice Department for making more than 100 payments totaling USD 1.7 million between 1997 and 2004 to a Colombian paramilitary group: The United Self-Defense Forces of Colombia (AUC) was designated as a terrorist organization by the US government in 2001. Chiquita argued that the payments were made to the AUC in order to protect its employees, and agreed to pay USD 25 million in damages.

In June 2024, a Florida court ordered Chiquita to pay a further USD 38.3 million to Colombian families after finding the company liable for financing a paramilitary group responsible for their relatives' deaths.

In 2025, a Colombian court sentenced seven former Chiquita executives to more than 11 years in prison.

The company’s 2019 Sustainability Report highlights Chiquita’s self-described pioneering role as the first company in the industry to join the Rainforest Alliance in 1992. According to the report’s sustainability timeline, Chiquita achieved Rainforest Alliance certification for all company-owned farms by 2000 and fully adopted the SA8000 labor and human-rights standard by 2004. Chiquita framed these measures as part of a broader strategy to safeguard labor, human rights, and environmental protections.

Chiquita’s reputation, however, has suffered significantly as a result of the various court findings, with the potential for long-term effects on investor confidence, brand equity, and stakeholder trust.

Lawsuits and public scrutiny: Timeline

▪ 2007: Pleaded guilty to making payments to the AUC and fined USD 25 million by the US Department of Justice.

▪ 2015 – 2023: Faced multiple civil lawsuits in US courts alleging complicity in human rights abuses.

▪ 2024: Ordered by a US court to pay USD 38.3 million in compensation to the families of eight victims killed by the AUC.

▪ 2025: Seven former executives of Chiquita Brands sentenced by a Colombian court to more than 11 years in prison for financing right-wing paramilitaries during the country’s armed conflict.

# II. RepRisk detection and analysis

RepRisk identified and tracked warning signs well before the legal and reputational crises reached their peaks.

# Early alerts

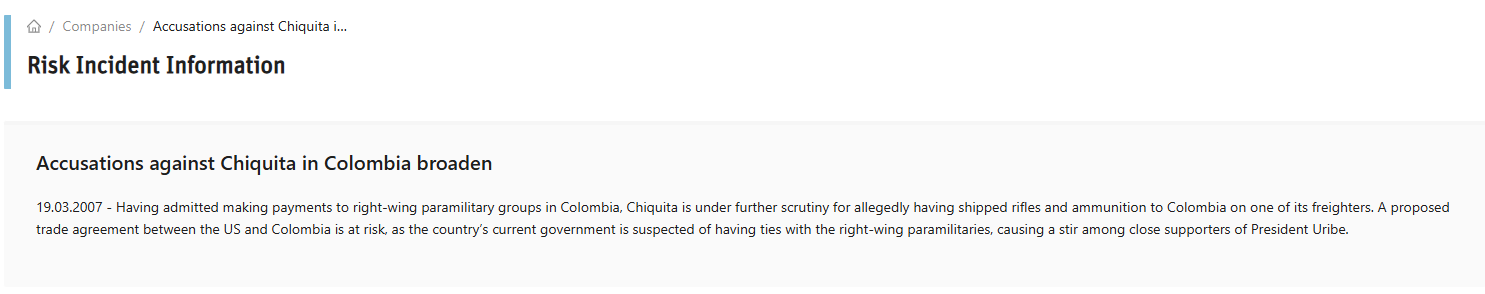

In early 2007, RepRisk flagged formal investigations in Colombia, which demanded the extradition of Chiquita staff in connection with terrorism funding and weapons transport, prior to the company facing the first major lawsuit in the US.

Example risk incident summary on the RepRisk platform

# Quantified risk signals

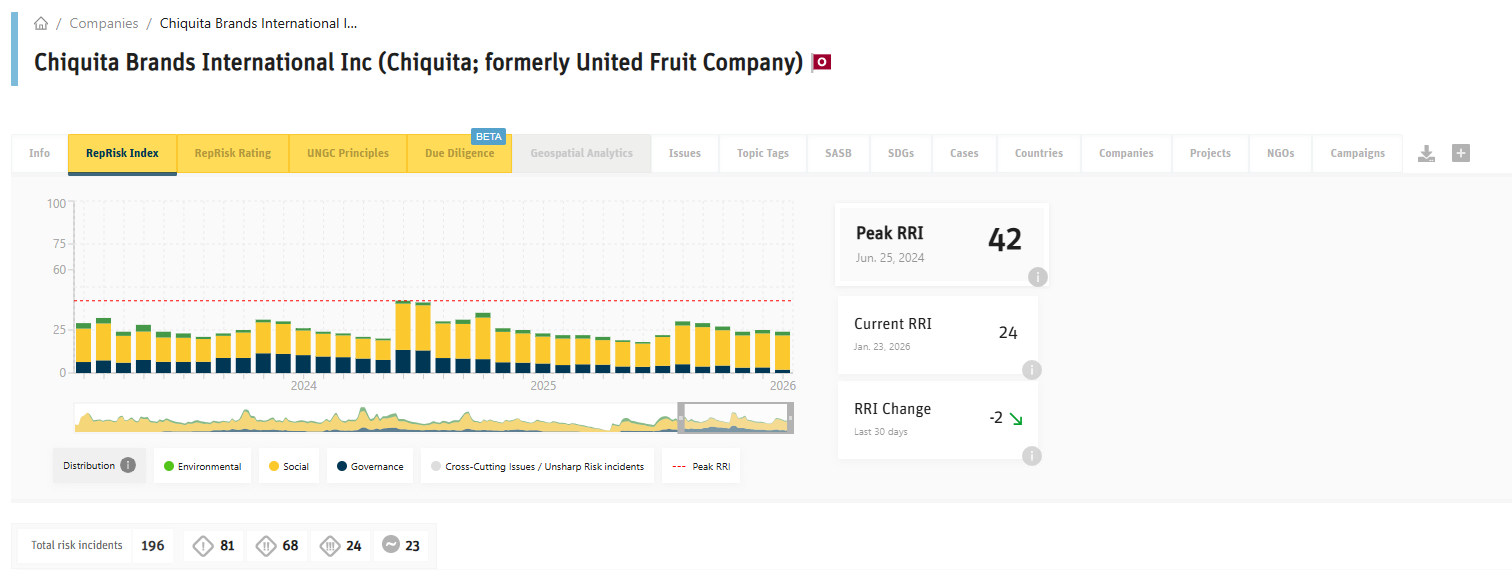

The RepRisk Index (RRI) is a proprietary metric of reputational risk exposure (0–100) that facilitates an initial assessment of the business conduct and reputational risks associated with a particular entity. Chiquita’s RRI score showed significant fluctuations aligned with legal developments:

- Between September and November 2023, when the US court advanced the case, Chiquita’s RRI rose from 23 to 31.

- Following the 2024 US court settlement, Chiquita’s RRI peaked at 42, signaling heightened reputational risk.

Chiquita’s RRI reaches a peak of 42 in June 2024

# Focused risk profile

The volatility in the RRI reflects not only the scale of media and legal scrutiny, but also the underlying nature of the risks themselves. A closer look at the composition of risk incidents linked to Chiquita between 2007 and 2025 reveals many relate to human rights.

# Chiquita risk incidents 2007-2025

# III. Impact and lessons learned

The Chiquita case demonstrates how business conduct risk can escalate into substantial legal, financial, and reputational consequences when early warnings go unheeded.

- Financial impact: Fines and settlements totaling more than USD 60 million, alongside significant legal expenses and lost business opportunities.

- Reputational damage: Years of negative media coverage are likely to have eroded consumer trust, and strained stakeholder relations.

The Chiquita case underscores how systematic due diligence and ongoing monitoring can reveal critical warning signs well in advance of reputational and financial damage. RepRisk’s combination of advanced AI with expert human analysis and deep domain expertise offers the transparency and foresight needed to protect assets, uphold corporate integrity, and maintain stakeholder trust.

Learn more

Discover how you can use RepRisk data to spot emerging business conduct risk: request a demo.

Copyright 2026 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.