May 05, 2022

How to effectively measure S: addressing the myths, assessing the data, and benchmarking for progress

Several high-impact events in recent years, including COVID and social justice movements, have propelled social factors to the forefront of ESG considerations. And yet, the narrative around “S” factors remains that there are no reliable means of measurement. The cost of ignoring social factors is increasingly high – so how can financial decisionmakers, businesses, and policymakers ensure meaningful analysis and understanding of “S” factors to effectively integrate them into decisions?

To dispel the myths and cut to the heart of what truly effective “S” ESG data is and can do, speakers from RepRisk, the International Sustainable Finance Centre (IFSC), and the World Benchmarking Alliance (WBA) joined forces to address:

A recent report from the ESG Working Group, led by the Thomson Reuters Foundation, that explores social data myths;

Alternative data methodology and “S” data trends; and

Applications of "S" data and benchmarking.

Our speakers:

Linda Zeilina, Founder and CEO, International Sustainable Finance Centre (ISFC)

Alexandra Mihailescu Cichon, Executive Vice President, Sales and Marketing RepRisk

Talya Swissa, Research Project Manager, Corporate Human Rights Benchmark (CHRB) at World Benchmarking Alliance (WBA)

Our moderator:

Gina Jurva, Attorney/Manager, Market Insights & Thought Leadership, Corporate and Government, Thomson Reuters

# Part 1 with Linda Zeilina: Myths and realities

The ESG Working Group responsible for the publication of a new report, Amplifying the “S”: Investor Myth Buster, set out to address the myths, highlight the “S” indicators available to the investor community, and expand their use. Using a robust methodology, the Working Group compiled a list of the most common myths around social factors and proceeded to address them.

Source: ESG Working Group, esg.trust.org

Like many myths, The Working Group found that those around "S" data were founded in truth – a truth, however, that has long been obsolete. “We realized that actually there might be a small grain of truth in some of [the myths], but the reality has really moved on,” said Linda Zeilina, IFSC.

First and foremost, the Working Group addressed investors’ uncertainty of the financial materiality of social factors. “We actually have a very well-established link between business and human rights,” said Zeilina. “We saw what happened in the case of Boohoo, where it significantly affected returns and illustrated the materiality of sound human rights practices in good business and good investment strategy.”

The Working Group identified another pain point in data availability. Capital allocators claim that “S” indicators are immeasurable and that useful data is sparse – and that self-reported data, such as company-disclosed policies are unreliable in assessing real “S” impact. The solution? Alternative data options that look beyond – or even exclude – what companies disclose about themselves.

“Some of [the indicators] will show whether these policies actually work in practice... having a policy is very nice, but you also need to know whether it works,” said Zeilina.

# Part 2 with Alexandra Mihailescu Cichon: Assessing the data

RepRisk provides financial decisionmakers, businesses, and policymakers with “S” indicators that serve as a reality check for how companies actually behave.

“The data is there,” said Alexandra Mihailescu Cichon, RepRisk. “It's there for private companies, it's there for supply chain, it's there for emerging and frontier markets.”

An analysis of the RepRisk dataset from the last two years – which excludes company self-disclosures –showed the depth and breadth of coverage. 47% of companies (34,000) were exposed to an “S” risk incident. 10% of forced labor and 19% of child labor “S” incidents were linked to misleading communication – indicating that as greenwashing for “E” issues, social washing is a problem for “S.”

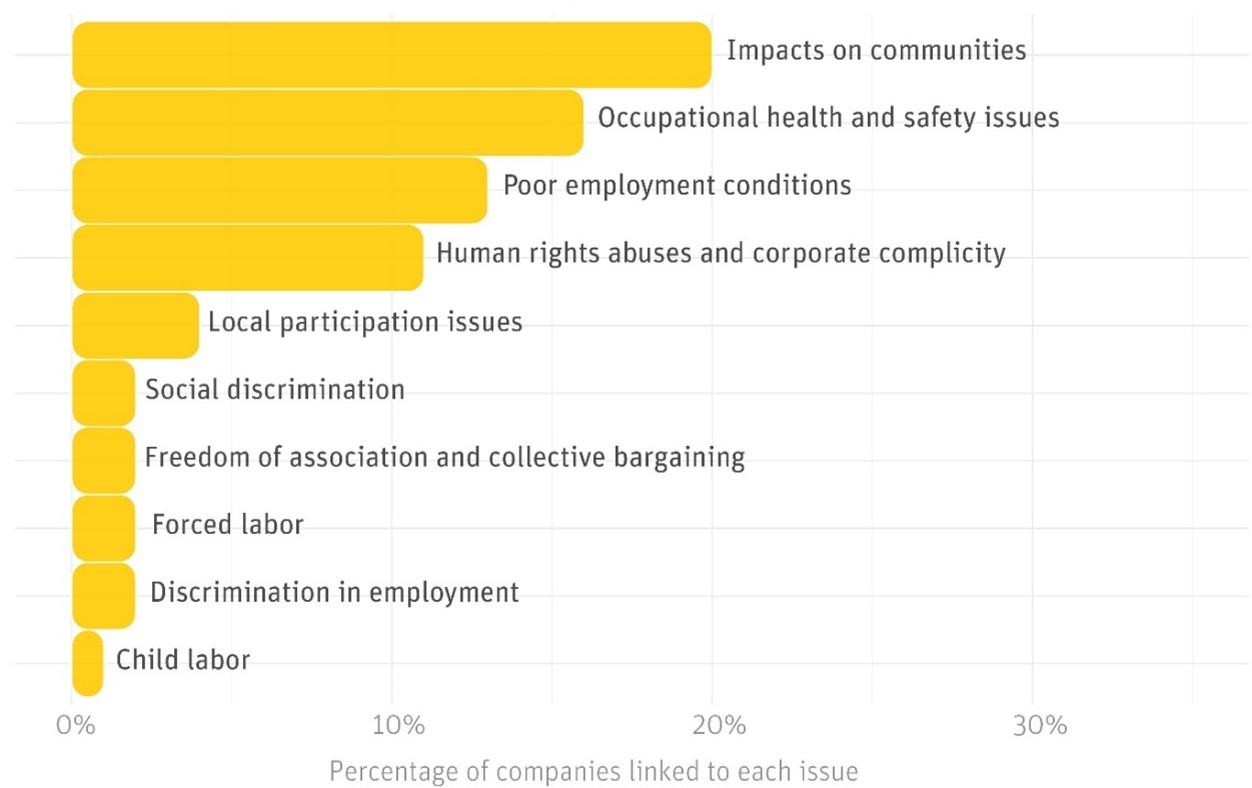

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Further analysis showed that the top three issues prevalent among companies with “S” risk incidents were impacts on communities, occupational health and safety issues, and poor employment conditions.

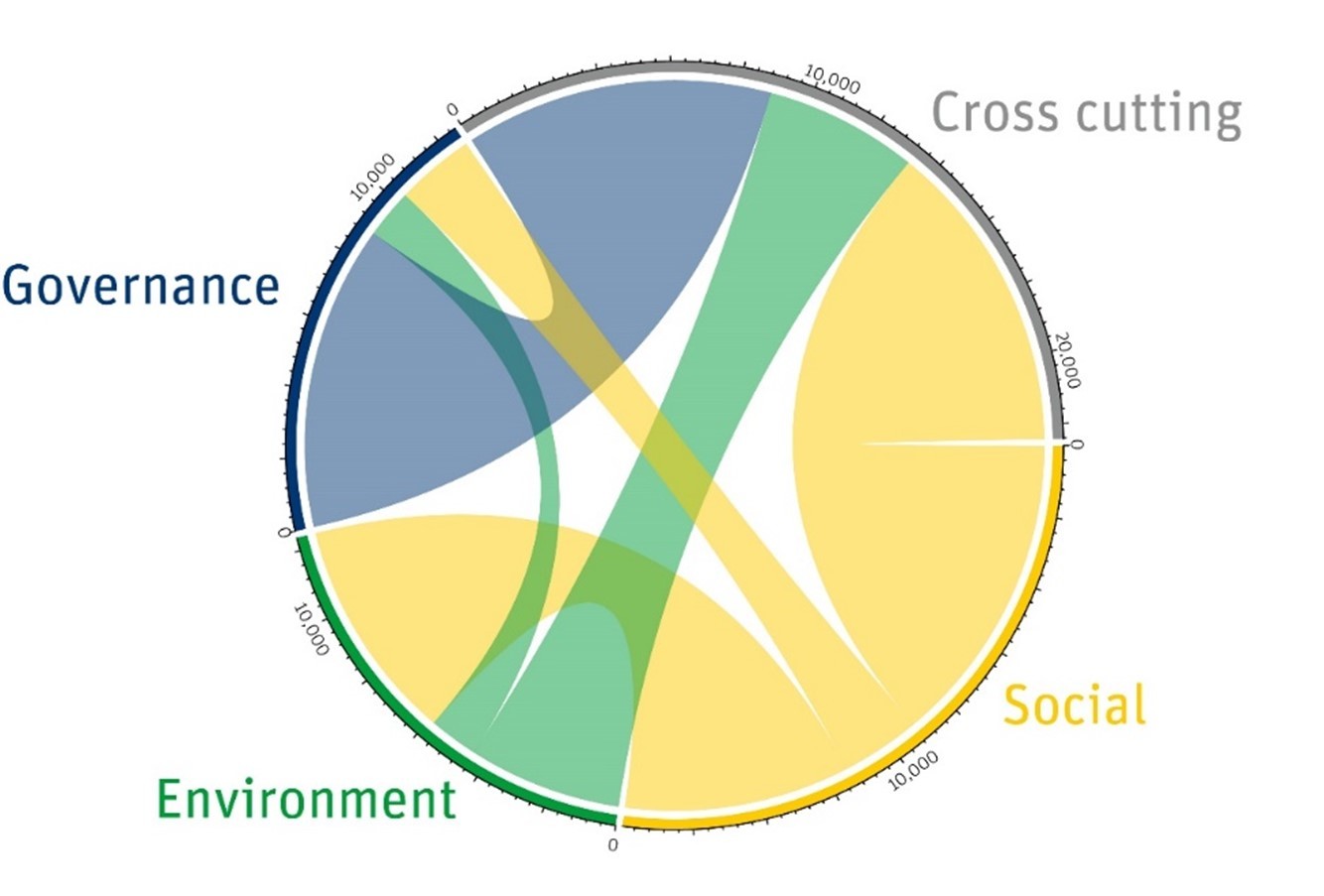

The data also revealed that “S” issues are, more often than not, inextricable from E and G – making a case for the use of a holistic, comprehensive dataset, one capable of revealing a mining project’s impacts both on local ecosystems and the surrounding community. “[ESG data is] multi-dimensional and you can't just neatly pack issues into their respective pillars,” said Mihailescu Cichon.

*The thickness of the connections indicates the number of 2021 incidents that are linked to both issue groups.

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

# Part 3 with Talya Swissa: Benchmarking for progress

The World Benchmarking Alliance’s (WBA) Corporate Human Rights Benchmark (CHRB) uses RepRisk ESG risk incident data to assess allegations of negative risk incidents and company responses. Their methodology comprises approximately 50 indicators, including sector-specific indicators across five measurement areas like Governance and Policies, Embedding Respect and Human Rights Due Diligence, and Remedies and Grievance Mechanisms.

Source: World Benchmarking Alliance’s (WBA) Corporate Human Rights Benchmark (CHRB), www.worldbenchmarkingalliance.org

“[The CHRB] is one of the oldest WBA benchmarks, with several years of data,” said Talya Swissa, WBA. “We're able to identify trends, track progress of companies and sectors, and see where gaps continue to exist.”

The WBA looks at sources beyond company self-reporting and gets closer to impacts on the ground. Some of the most common incidents assessed include forced labor, health and safety, and child labor.

The CHRB’s results are used by stakeholders across the board, including the benchmarked companies themselves, as well as policymakers and capital allocators.

“We know that the benchmark equips investors with data to inform their engagement with companies and encourage those who are not performing in line with international human rights standards to improve,” said Swissa. “This engagement occurs between individual investors and companies, but also through collective actions.”

For example, a group of more than 170 investors cosigned a public letter in 2020 that was sent to ninety-five companies scoring zero on human rights diligence in the WBA 2019 benchmark. The letter urged them to improve rapidly in time for progress to show in the next benchmark.

Conclusion:

While the mythology around “S” data persists, the evidence shows that “S” data is readily available and can be used to help assess and address underlying social risks and ensure investment decisions integrate human rights factors. Our speakers shared examples of data in action and helped illustrate how.

The tools necessary for financial decisionmakers and asset allocators need to ensure sufficient and accurate coverage are available now and can be implemented in meaningful ESG work across complex supply chains and emerging and frontier markets. What’s more, artificial intelligence and geospatial analytics are expected to increase the scope and improve the accuracy of available data, making it easier to ‘cut through the noise’ and find reliable, actionable metrics to drive positive change. Finally, new and incoming regulation such as the UK Modern Slavery Act, the Australia Modern Slavery Act, and the California Transparency in Supply Chains Act, put pressure on corporate practices, and advocates who are monitoring these laws are pushing to create more standardized reporting metrics.

We encourage you to watch the webinar for more details on how “S” data can be integrated into investment decisions aligned with human rights and social responsibility within ESG:

About RepRisk

Founded in 1998 and headquartered in Switzerland, RepRisk is a global technology company that provides transparency on business conduct risks like deforestation, human rights abuses, and corruption. RepRisk enables efficient decision-making for clients and supports alpha generation and value preservation for their organization, investments, and business interests. RepRisk is trusted by 80+ of the world’s leading banks, 17 of the 25 largest investment managers, corporates, and the world’s largest sovereign wealth funds for their due diligence processes. RepRisk uses human curation and cutting-edge artificial intelligence to generate the world’s most comprehensive business conduct and biodiversity risk datasets on public and private companies, real assets, and countries.

Visit us at www.reprisk.com.