# The challenge

A tier 1 global bank set out to strengthen its approach to responsible finance by applying a groupwide Environmental and Social Risk (ESR) framework across all client onboarding, Know-Your-Client (KYC) reviews, transaction assessments, and product/service evaluations. However, the bank faced significant challenges:

- Manual ESR checks were time-consuming and inconsistent, leading to delays and potential gaps in risk identification.

- The growing volume and complexity of transactions made it difficult to ensure that all clients and deals were screened thoroughly and in line with policy.

- Compliance teams needed a way to systematically flag and escalate high-risk clients or transactions for expert review, without overwhelming resources.

# The solution

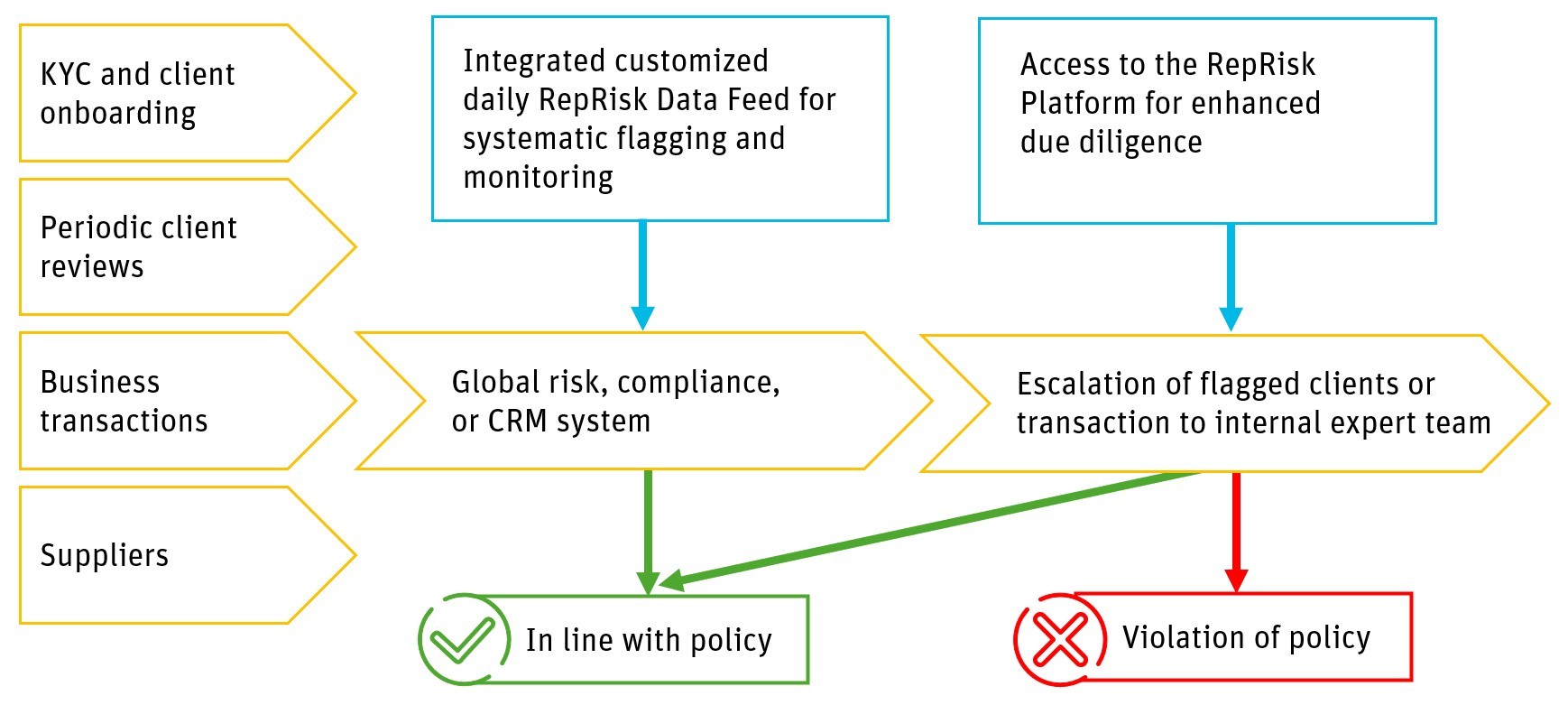

To address these challenges, the bank integrated RepRisk’s data feed into its internal compliance and risk management tools, creating an automated and standardized ESR review process. Key elements included:

- Automated ESR checks: RepRisk data powers daily, automated screening of clients and transactions, ensuring that all relevant parties are assessed against the bank’s ESR framework.

- Custom risk models: A bespoke model, powered by a RepRisk data feed, identifies and flags companies with potential E&S risks before onboarding or transaction approval.

- Integrated compliance workflow: The bank’s internal compliance tool cross-checks all clients and transactions against RepRisk’s risk indicators, streamlining the escalation of flagged cases to expert teams.

- Enhanced due diligence: Access to the RepRisk Platform enables deeper investigation and documentation for flagged clients, supporting robust decision-making and audit trails.

# The impact

By embedding RepRisk data into its ESR review process, the bank achieved:

- Faster, more consistent risk assessments: Automated checks reduced manual workload and ensured that every client and transaction was screened using the same rigorous criteria.

- Improved policy alignment: All onboarding, KYC, and transaction reviews are now systematically aligned with the bank’s groupwide ESR policy, reducing the risk of non-compliance.

- Efficient escalation and monitoring: High-risk clients and transactions are automatically flagged for expert review, enabling compliance teams to focus on the most critical cases.

- Comprehensive coverage: The solution supports a wide range of banking activities, including trade and export finance, project finance, investments, IPOs, credits, and advisory services.

# Why it matters

RepRisk’s data integration empowers banks to operationalize their ESR frameworks at scale. By automating and standardizing risk reviews, financial institutions can enhance compliance, reduce risk, and accelerate business processes.

Learn more

To understand how your institution can integrate RepRisk’s data into your workflows, request a demo.

Copyright 2025 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.