# The challenge

A tier 1 global bank needed to strengthen its approach to vendor risk management across a vast and complex supply chain, involving more than 5,000 suppliers worldwide. The bank’s procurement team faced several challenges:

- Manual risk classification and mapping were time-consuming and prone to inconsistencies.

- Identifying and monitoring risky suppliers was difficult at scale.

- Ensuring compliance with internal policies and regulatory requirements required a more systematic, data-driven approach.

# The solution

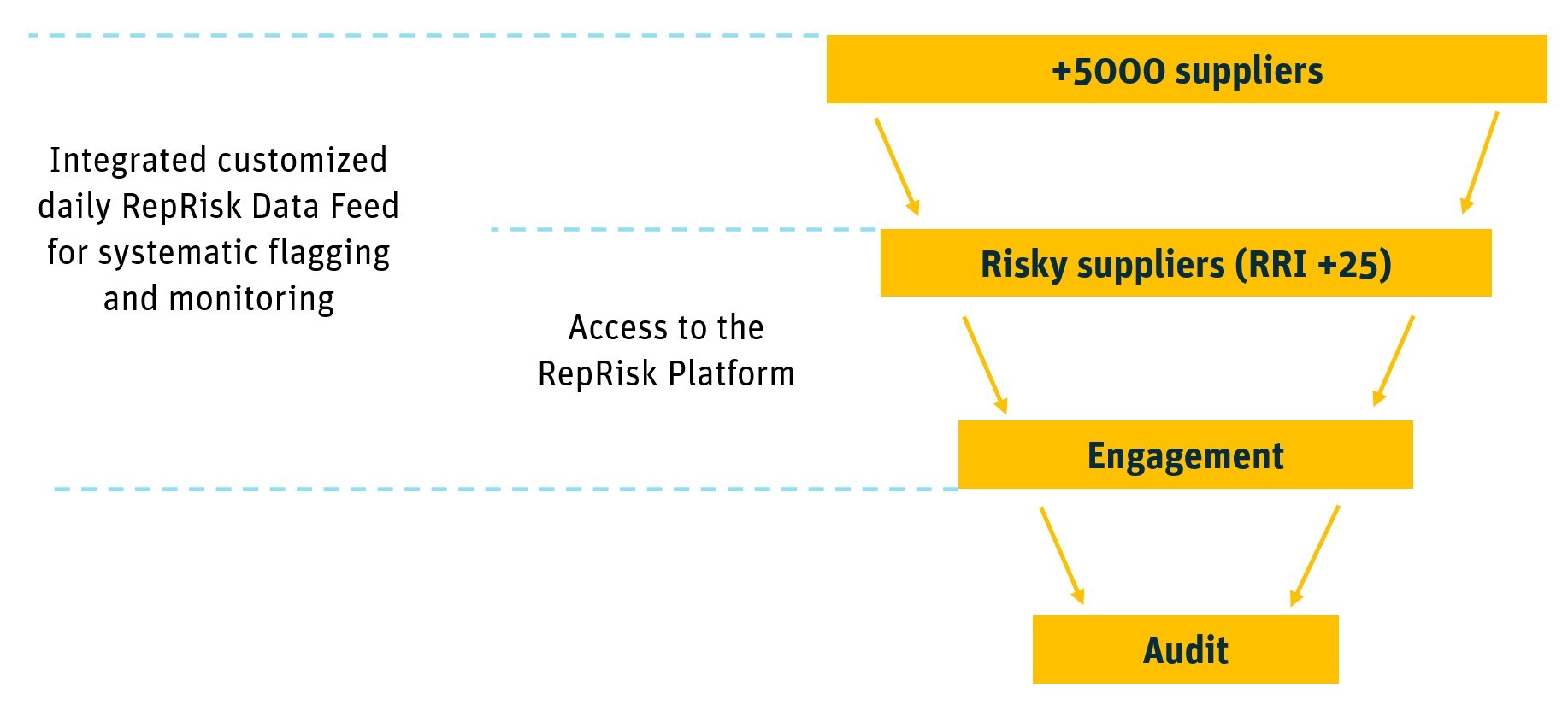

To address these challenges, the bank integrated RepRisk’s data feed and platform into its global procurement vendor risk management (VRM) workflow. This solution enabled the bank to:

- Automate daily risk screening: RepRisk’s data feed systematically flags and monitors suppliers, ensuring that those with a RepRisk Index (RRI) above 25 are automatically identified for additional due diligence.

- Harmonize risk assessment: Business conduct risk assessments are embedded into supplier onboarding and ongoing monitoring, ensuring consistency across the entire supply chain.

- Enable efficient engagement and escalation: Risky suppliers are flagged for further engagement, audit, or escalation, allowing the procurement team to focus resources where they are needed most.

- Support compliance and auditability: All risk assessments and actions are documented, supporting internal compliance and external regulatory requirements.

# The impact

By leveraging RepRisk’s automated data feed and platform, the bank achieved:

- Systematic risk classification and mapping: Every supplier is screened using consistent, objective criteria, reducing manual workload and human error.

- Proactive risk identification: Suppliers with elevated risk scores are flagged early, enabling timely intervention and reducing exposure to reputational and compliance risks.

- Streamlined monitoring and engagement: The procurement team can efficiently monitor, engage, and audit suppliers, ensuring ongoing compliance and risk mitigation.

- Scalable, global coverage: The solution supports the bank’s entire supplier base, regardless of size or location, enabling enterprise-wide risk management.

# Why it matters

RepRisk’s data integration empowers banks to operationalize supply chain risk management at scale. By automating vendor screening and embedding business conduct risk into procurement processes, financial institutions can protect their reputation, ensure compliance, and build more resilient supply chains.

Learn more

To understand how your institution can integrate RepRisk’s data into your workflows, request a demo.

Copyright 2025 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this case study. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this case study must include the entire case study to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.