Outperform with confidence. Risk intelligence built for investment due diligence

In today’s volatile markets, asset managers and asset owners face growing pressure to deliver performance, meet regulatory demands, and uphold fiduciary duty, all while managing reputational and business conduct risks. RepRisk provides the clarity and foresight you need to stay ahead.

Flexible delivery of investment risk metrics for asset managers and owners

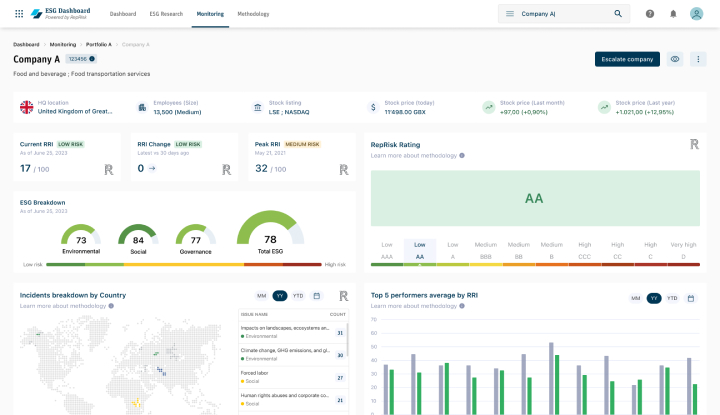

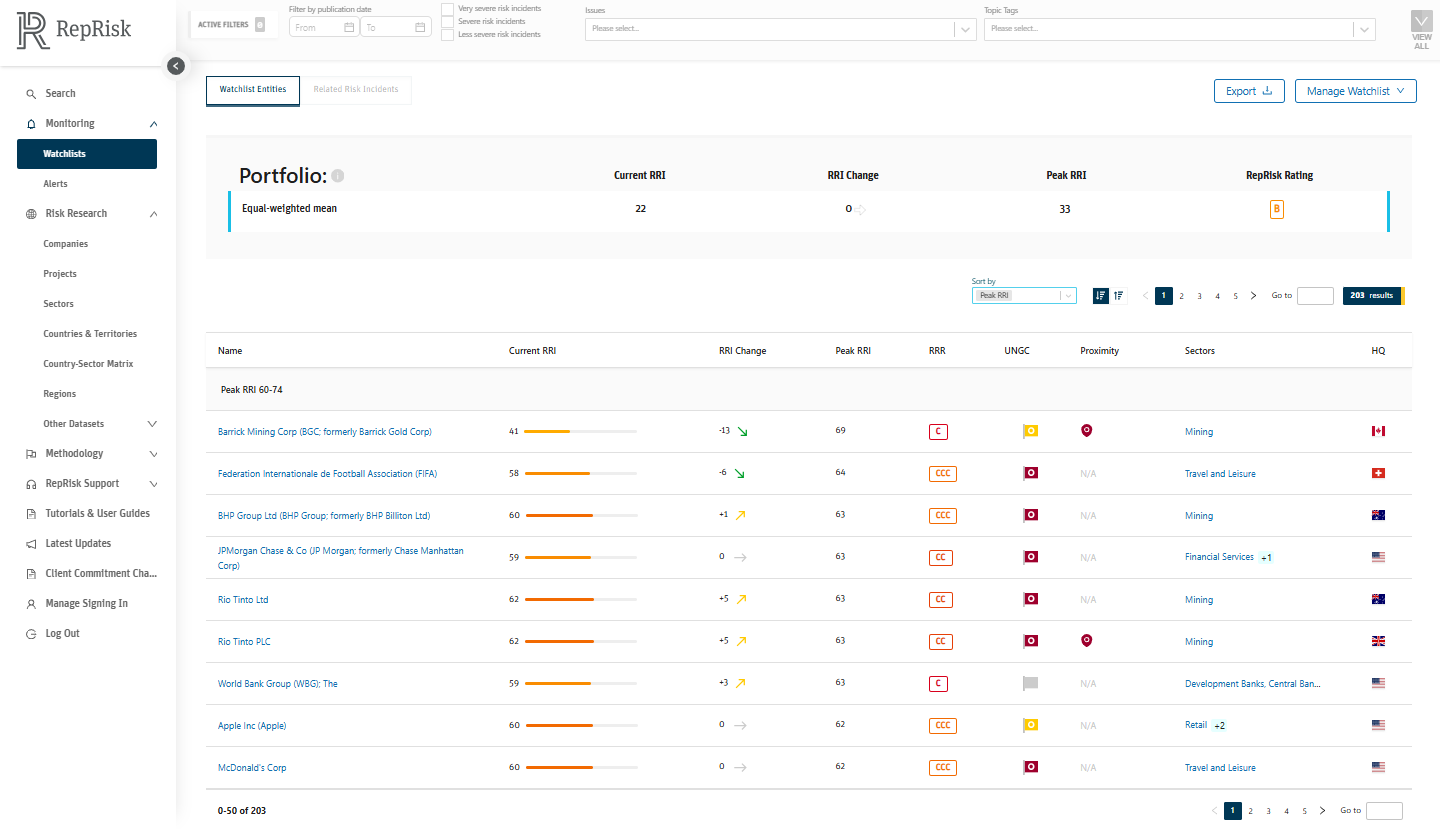

Stay ahead of the curve with risk data that’s actionable, scalable, and built for the future of investing. Access reputational risk data and business conduct insights via the full database on the RepRisk platform, or integrate our proprietary risk metrics into your internal systems via data feed, API, or 3rd party solutions such as Snowflake, Blackrock’s Aladdin, and more.

Why leading investors trust RepRisk

RepRisk is the world’s most respected Data-as-a-Service (DaaS) provider for reputational risk intelligence and business conduct data. With unmatched coverage, accuracy, and speed, we help you:

- Make better-informed investment decisions

- Protect and enhance brand reputation

- Meet evolving regulatory and fiduciary obligations

- Drive alpha and outperform benchmarks