Hidden risks. Real losses.

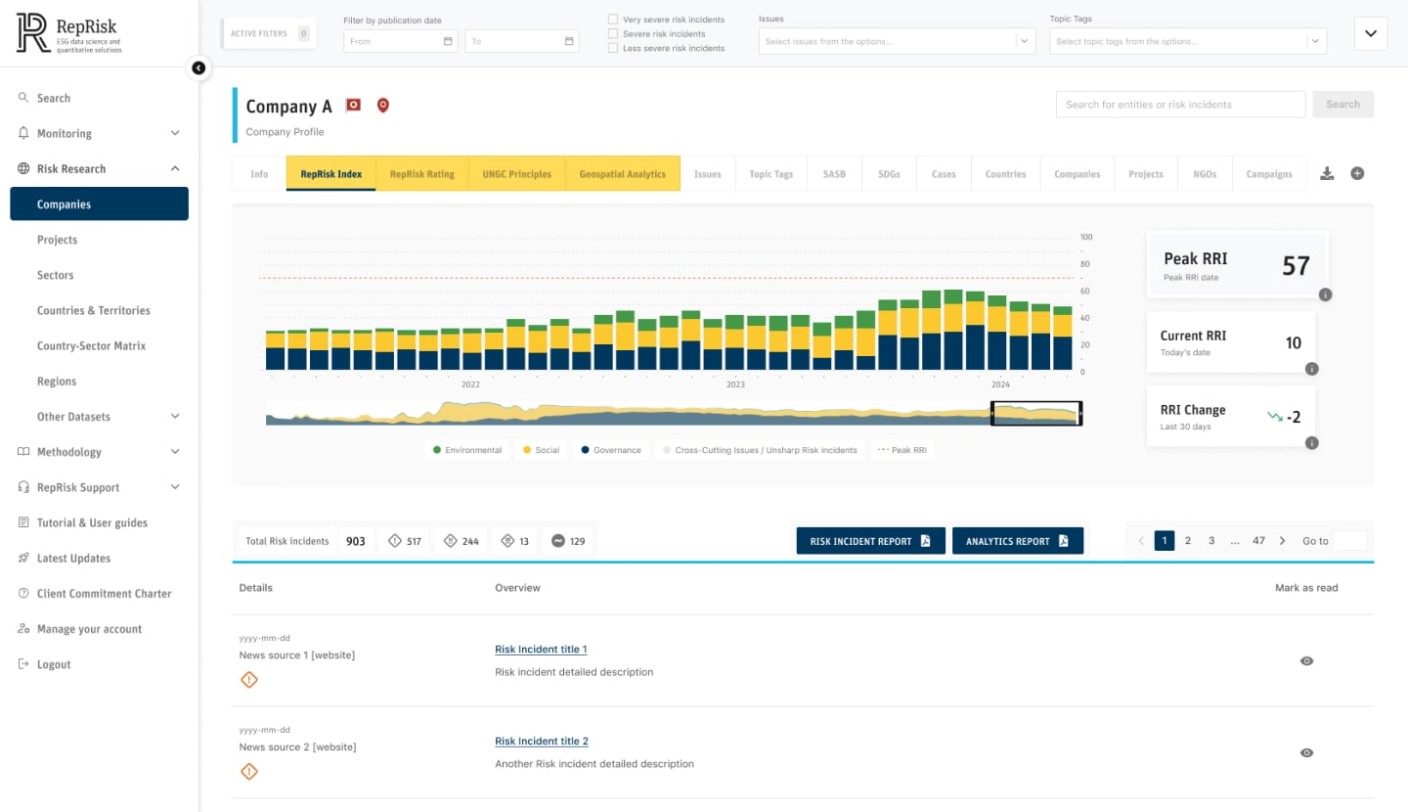

Even the best investment strategies can be derailed by unseen reputational risks. Cheap or incomplete data can cost millions. Delivered via the RepRisk platform, API, or Data Feeds, RepRisk data provides the reliability you need to stay ahead.

Reputational risk metrics that drive portfolio performance

- Make better-informed investment decisions

- Protect and enhance brand reputation

- Meet evolving regulatory and fiduciary obligations

- Drive alpha and outperform benchmarks

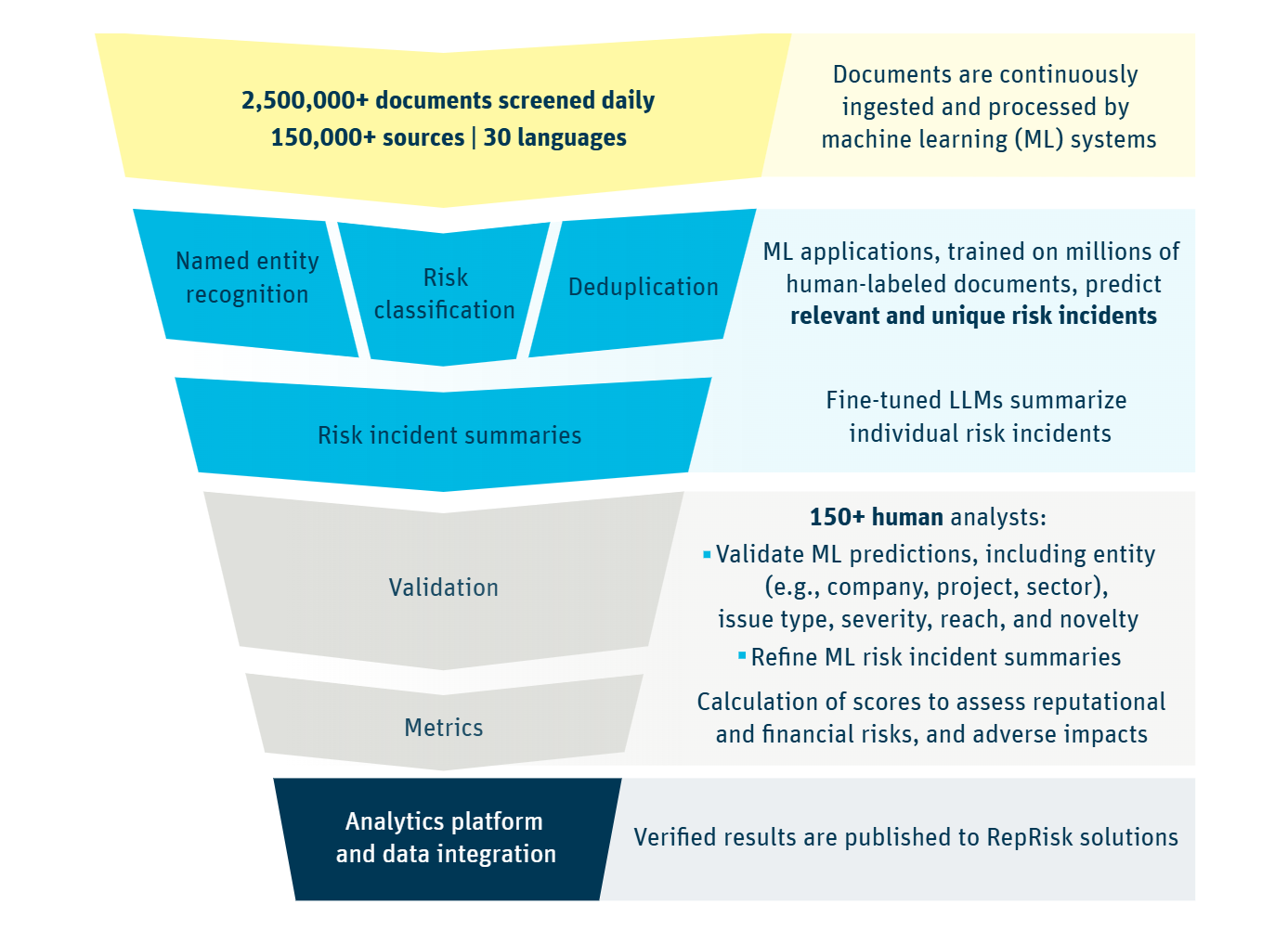

Human intelligence x artificial intelligence: the RepRisk difference

The combined power of human intelligence (HI) x artificial intelligence (AI) – with humans in the lead – is what sets our solutions apart. After all, AI models can only be as accurate as the sources and data that feed them.

While many have recently jumped on the AI bandwagon, RepRisk has been at the forefront of AI innovation since 2007.

Clients choose RepRisk data because they know they can rely on its relevancy, accuracy, and speed for actionable reputational risk data.